Digital financial market infrastructure platform

- #Distributed ledger technology

- #FinTech

- #KYC

- #Transaction monitoring

About the Client

The client represents an intelligent global digital financial market infrastructure (dFMI) built to empower billions of people to instantly transact in any digital asset, anywhere on Earth, at any time.

Business Challenge

Existing global payment systems are becoming outdated and no longer meet the demands of today’s business dynamics, new types of assets, and trans-border operations.

Our client needed to build a scalable, secured system that allows users to create transactions instantly in any asset at any time. Our task was to implement an engine that supports transaction processing and API to integrate with other systems, like e-Commerce, Point-of-Sale, Mobile Applications, and IoT. The system should comply with international and local laws requirements.

Solution Overview

The dFMI platform is designed to complete existing solutions such as VISA or MasterCard, offering customers a more flexible, efficient, and productive solution with a guarantee of high-level privacy and security.

It supports asset issuing and movement as well as distributed exchange (DeX) of asset that has been added to the platform’s network.

The solution includes the following major high-level sub-systems:

- Transaction Engine for efficient and reliable financial transaction processing, user accounts, and security management.

- Infrastructure support ensures system scalability, performance, security, and fault tolerance.

- Mobile Application Platform supports mobile applications for funds transfer for B2C and C2C business models.

- Integration modules: e-Commerce API, Point-of-Sale API, Developer API.

Project Description

This Distributed Ledger Technology (DLT) facilitates a system to tokenize the assets, providing digital liquidity, which turns institutions into custodians of assets and allows for the circulation of tokens instead of assets.

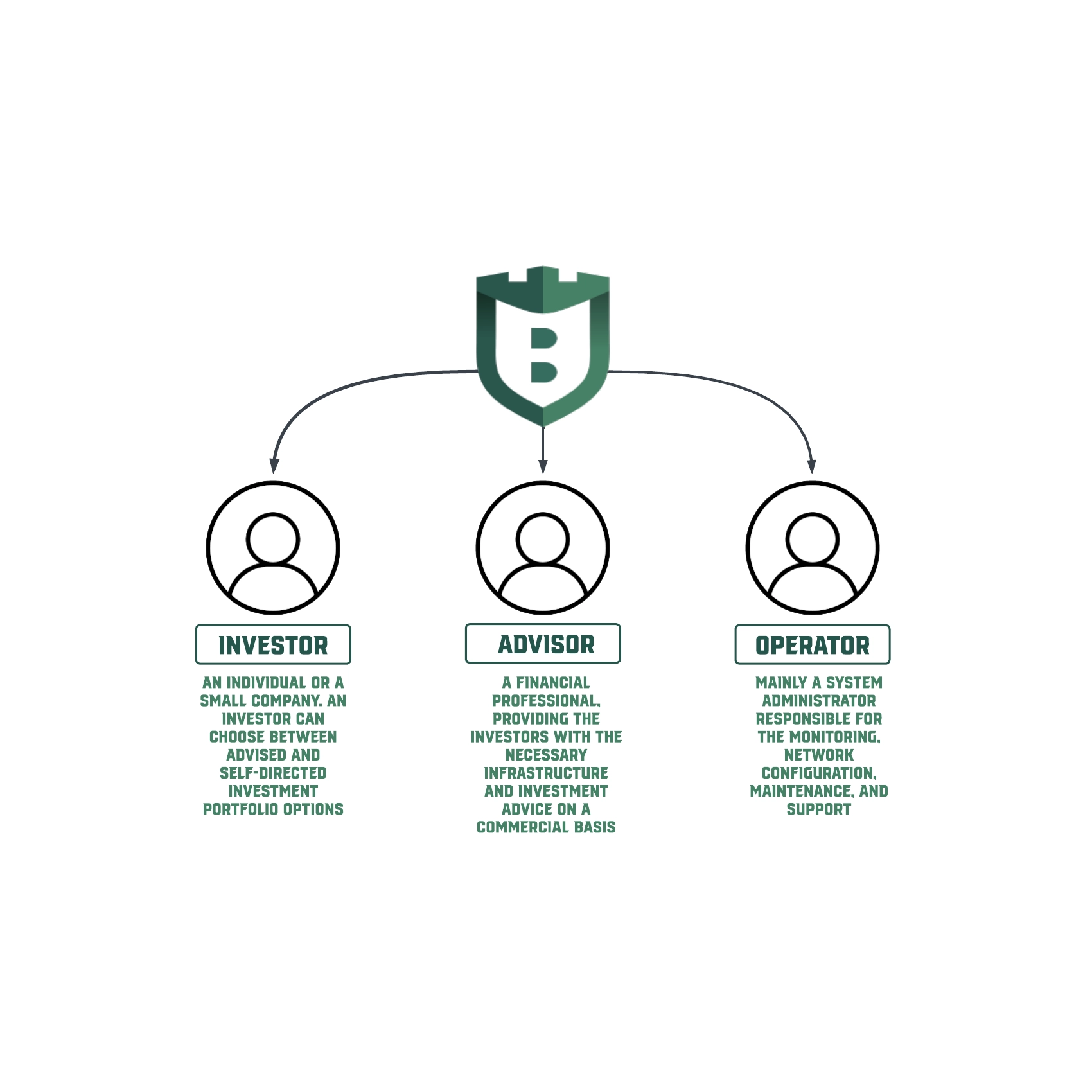

The key user’s classes of the system are:

- dFMI custodian banks — store fiat currency to ensure the liquidity of digital assets.

- dFMI operators — operate as licensed by the local authorities’ financial institutions (similar to banks in the ‘usual’ financial system). They manage clients’ dFMI accounts, providing them with services like personal user cabinets and tokenizing/de-tokenizing assets (exchanging fiat currency into digital assets and vice versa).

Each end user’s account is maintained through high security and privacy-focused design, allowing end users to remain anonymous on the platform. But it still can de-anonymize persons by legal authorities’ requests to the platform based on applicable laws.

The platform also guarantees strong data immutability because of a blockchain ledger that stores all the meaningful data (e.g., account balances and transaction information). It makes the system transparent and auditable for different interested (and authorized) parties.

To provide the platform participants with the high spectrum of services that are usually required, the dFMI platform integrates with different external services such as:

- Know Your Customer (KYC) services, allowing it to incorporate and use various third-party KYC services, for example, by geographical principle.

- Payment gateways — allow integration with and use of local or most appropriate payment services to operate with fiat currencies.

Several use-cases to illustrate the purpose of the platform:

- The platform end user scans with their mobile device a QR code from the merchant’s PoS device and approves the payment in digital currency for some goods or services the merchant provides.

- The platform end user in Germany transfers digital currency to his friend in the USA, who withdraws that digital currency, converting it to fiat USD.

- The Platform end user having digital assets on their system account converts it to fiat currency on their ‘normal’ bank account.

Each transaction on the platform is subject to KYC checks and against local requirements for financial institutions (Platform Operators), mitigating the risks of illegal financial transactions.

Let's discuss your idea!

Technological Details

This system can be described as a hybrid architecture solution built on Distributed Ledger Infrastructure, using Account-based access to tokenized value stores and enabling cross-border transaction support.

It supports the performance of up to 50,000 transactions per second worldwide. The platform can perform real-time aggregation, clustering, transaction deconstruction, and transaction execution at scale and across multiple tokens/assets with the efficiency of a High-Frequency Trading (HFT) system.

The dFMI platform is a private permissioned distributed system consisting of individual nodes. Each node is built on the Federated Byzantine Agreement-based Stellar Consensus Protocol (SCP).